[BREAKING] Taeyeon and Ravi reported to be dating

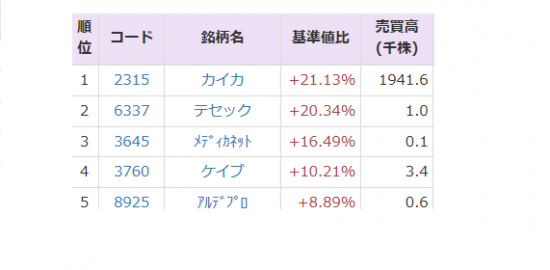

See Zee Business Live TV Streaming Below: The 30-share BSE Sensex zoomed 2,314. Relief on TDS for dividend on REITs and InvITs will boost investment in these instruments," said Krish Raveshia, CEO at Azlo Realty. 75 lakh crore with a planned initial public offering IPO of Life Insurance Corporation LIC among the state-run companies that will be sold in the next fiscal. " The proposals to privatise 2 state-run banks and one general insurance firm is noteworthy, as is increase in FDI limit in insurance to 74 per cent. 74 per cent to finish at 14,281. It is an independent newspaper in the real sense of the term. For Nifty, 14200 is the level to watch on a closing basis. The deficit is likely to come down to 6. Sitharaman on Monday proposed more than doubling of healthcare spending while imposing a new agri cess on certain imported goods and raising customs duty on items ranging from cotton to electronics in a bid to pull the economy out of the COVID-induced trough. On similar lines, the broader NSE Nifty soared 646. Steps like a 1-year tax holiday for affordable housing projects and a 1-year extension for an additional deduction of interest up to Rs 1. It was started by Sardar Dyal Singh Majithia, a public-spirited philanthropist, and is run by a trust comprising five eminent persons as trustees. Additionally, the minister announced that Foreign Portfolio Investors FPI will now be enabled to debt finance REITs and INVITs after necessary amendments to the law. But to reduce the burden on consumers, the customs or import duty on these items was cut. The revenue target from privatisation of PSUs was put at Rs 1. Privatisation of two nationalised banks and proposal of monetisation of assets like land are clear positives," said V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services. The move of rationalization of spends, minimal changes to the direct and indirect taxes and no additional taxes will be well received. Equity market will be enthused with no tinkering in capital gains taxes or STT or any form of COVID tax. The policy would give a clear roadmap for disinvestment in strategic and non-strategic sectors. On the currency front, the rupee slipped 6 paise to settle at 73. Meanwhile, the global oil benchmark Brent crude futures rose 0. If manages to surpass, we may see it heading higher. Comus International was founded in June 1978 by our Chairman and CEO, Robert P. Taxes, both direct and Indirect, were left untouched. Absence of the much-feared Covid-19 tax and the surcharges on income tax is a great relief. 61, while Nifty 50 ended at 14,281, up 646 points or 4. BSE Sensex hit an intraday high of 48,381. We believe that the RBI will be in sync with the Govt and both will take necessary action to prevent this happening. The high fiscal deficit was expected because of low growth leading to lower tax revenues and higher government spending to support lives and livelihoods. replace 'international','world'. IndusInd Bank topped the Sensex gainers' chart with a jump of 14. [UPDATE 1] Both SM Entertainment and GROOVL1N have stated that they are checking with their artists. Absence of the much-feared COVID tax and the surcharges on income tax is a great relief. Market has given a clear thumbs-up. On the other hand, Dr Reddy's, Tech Mahindra and HUL were the laggards. Comus International is commited to Customer service. The BSE benchmark Sensex skyrocketed 2,315 points on Monday, propelled by gains in financial stocks, as market participants cheered a growth-oriented Union Budget presented by Finance Minister Nirmala Sitharaman. BSE bankex, finance, realty, capital goods and metal indices rallied up to 8. the two had been dating for about a year. All the key market indices witnessed a sharp rise as investors welcomed the big infrastructure and healthcare boost provided in the Budget. We are always looking to enhance and improve our Customer Service, and we look to you, our customers, for feedback about how we are doing and what we can do to improve your experience doing business with us. Unveiling the PSE policy in Budget 2021-22, Finance Minister Nirmala Sitharaman said barring four strategic areas, public sector companies in other sectors will be divested. The substantial increase in investment would strengthen institutions and improve existing conditions for the better. Further, laying prominence of disinvestment, especially of LIC has gone right. While Dr Reddy, Tech Mahindra and HUL were the only losers falling up to 3. Further, I also feel that the overall net-borrowing of government and the deficit figure is very much in control. On the other hand, Dr Reddy''s, Tech Mahindra and HUL were the laggards. The benchmarks were propelled by across-the-board buying, with banking and finance stocks leading the charge. A "substantially higher-than-expected" expenditure pushed fiscal deficit for fiscal 2021 and 2022 well above projections, Aditi Nayar, principal economist at rating agency ICRA told news agency Reuters, adding that yields were expected to sustain a hardening bias, in the absence of frequent open market operations. The much awaited proposal to set up a Development Finance Institution DFI should boost capex in the coming years, he added. The government projected a fiscal deficit of 9. Taeyeon and Ravi are reported to be dating. Mumbai, February 1 The BSE benchmark Sensex skyrocketed 2,315 points on Monday, propelled by gains in financial stocks, as market participants cheered a growth-oriented Union Budget presented by Finance Minister Nirmala Sitharaman. The budget was primarily focused on the infra and healthcare sector. This could lead to spreading the risk and reward of such investments across wider spectrum of sophisticated who under the extant guidelines may not have qualified as QIBs for direct investment in security receipts such NRIs, family offices etc: Shagoofa Rashid Khan, Partner and Head - Project, Investment, and Advisory Cyril Amarchand Mangaldas. In brief, the FM has presented a pragmatic, bold and visionary budget in these difficult times," he added. 40, the 30-share Sensex ended 2,314. There was an infrastructure push in the budget, focussing on development finance institution and asset monetization to fund the infra projects. Privatization of PSBs was another bold announcement. After Covid-19, as expected, a substantial increase in healthcare sector expenditure amount in the budget is a welcome and much needed step. According to Lav Chaturvedi, ED and CEO at Reliance Securities, the single securities market code announced in the Budget speech will bring about ease of doing business in the Indian financial markets. Krishna Kumar Karwa, Managing Director of Emkay Global Financial Services, added," A Budget with no changes in direct taxes will certainly be remembered for years to come. This, along with FDI regime and development financial institution, would be transforming for the financial markets, he added. 84 points or 5 per cent higher at 48,600. Fine print of announcements relating to ARC and asset management company to acquire, manage and sell stressed and distressed loans to AIFs needs to be assessed. Sitharaman also said the government would infuse Rs 20,000 crore into public sector banks PSBs in 2021-22, to meet the regulatory norms. They met through a common friend, and have been dating, even going on a Christmas date recently. One couldn't have asked for more, of the total borrowings of Rs 1,50,000 crore a whopping Rs 1,20,000 crore is going for investment. "This is indeed a bold growth-oriented budget. replace 'latest','latestnews'. Absence of the much-feared Covid tax and the surcharges on Income Tax is a great relief. According to Lav Chaturvedi, ED and CEO at Reliance Securities, the single securities market code announced in the Budget will bring about ease of doing business in the Indian financial markets. 84 points or 5 per cent to finish at 48,600. Infrastructure development will catapult the country on a higher growth trajectory and have positive cascading effects on many other sectors. The expansion in spending will be funded by higher borrowings which has the potential to create an upward pressure on inflation and interest rates a few months down the line. This was its second-biggest single day jump in absolute terms and the best day in almost 10 months. The story has been taken from a news agency. Mumbai, Feb 1 PTI The BSE benchmark Sensex skyrocketed 2,315 points on Monday, propelled by gains in financial stocks, as market participants cheered a growth-oriented Union Budget presented by Finance Minister Nirmala Sitharaman. Infrastructure growth in India is longing for a mega DFI with a bigger risk appetite, that will provide the much needed long term financing to new as well as stalled projects with long gestation periods, and will ease out the burden of commercial banks. According to the market watchers, the absence of any negative was the biggest positive for the D-Street. Market response to the budget reflects growth optimism. "It has been a great Budget in the current pandemic. Banking has been the major charioteer in this move. BSE Sensex reclaimed its crucial 48,350-mark, while the broader Nifty 50 index crossed 14,200 level. While extension of the deduction on payment of interest on purchase for affordable housing by another year will encourage home buyers to invest on their own properties, extension of the tax holiday on affordable housing projects will encourage more launches in this category: Ravindra Sudhalkar, CEO, Reliance Home Finance "The real estate industry was expecting growth measures from the Union Budget. As usual, implementation of the plan will be most important. Market response to the Budget reflects growth optimism. 54 lakh crore and and introduced an agri infra cess of up to 100 per cent on some goods to create post-harvest infrastructure for improving farmers' income. Elsewhere in Asia, bourses in Shanghai, Hong Kong, Seoul and Tokyo ended in the positive territory. Only three index components closed in the red -- Dr Reddy's, Tech Mahindra and HUL, shedding up to 3. The Tribune, now published from Chandigarh, started publication on February 2, 1881, in Lahore now in Pakistan. Domestic equity market benchmarks BSE Sensex and Nifty 50 ended 5 per cent higher on Monday in post Budget rally. 5 lakh on loan for affordable housing will benefit all stakeholders of the industry and boost investments. 26 per cent, which hit record high intraday. A stronger and sustainable rebound in the second half of FY2022 will help the government to improve its fiscal and debt situation in the years ahead. In the broader market, BSE Midcap and Smallcap indices rose 2-3 per cent. Strong breakout is witnessed in the nifty bank even nifty has seen small falling trend line breakout, going forward immediate support is formed near 14200-14070 zone holding above said levels we may see pull back to continue and resistance is placed at 14400-14500 zone: Rohit Singre, Senior Technical Analyst at LKP Securities The FM has delivered a unique Budget, wherein all the right measures have been proposed to speed up growth. The FM has not tampered with STT, or LTCG which could have otherwise spooked the markets. All sectoral indices ended with strong gains. Broader BSE midcap and smallcap indices surged as much as 3. 5 per litre on petrol and Rs 4 per litre on diesel was also slapped but this was offset by a reduction of an equivalent amount in the excise duty -- making it price neutral for consumers. Barring Nifty Pharma, all the Nifty sectoral indices ended in the green led by Nifty Bank index Share Market on Budget 2021 HIGHLIGHTS: Domestic equity market benchmarks and ended 5 per cent higher on Monday in post Budget rally. Meanwhile, foreign portfolio investors FPI have remained net buyers to the tune of Rs 14,649 crore in Indian markets in January, amid availability of global liquidity and emerging markets being a preferred destination for foreign funds. Immediate success and rapid growth led to new product development and soon the metal mercury switch and, ultimately, the patented non-mercury switch were designed and offered to the market. With this announcement, listed insurance sector players were seen zooming higher during the day. The 30-share BSE sensex rose 2,315 points or 5 per cent to close at 48,601; while the broader NSE Nifty settled 647 points or 4. Global markets were on an upswing amid increased retail participation in select stocks. On the NSE platform, sub-indices Nifty Bank, Private Bank, and Finacial Services gained up to 8. The expenses will continue to remain high in FY2022 as infection reduces and vaccination exercise gains strength. The market has given complete thumbs up to this mega event has recovered a fair bit of ground. Higher spending will kickstart a virtuous cycle of growth. Sensex surged 2,315 points or 5 per cent to 48,600. NEW DELHI: Equity indices cheered the announcements made by finance minister in Union Budget 2021 with the benchmark BSE sensex jumping over 2,300 points led by gains in banking, financial stocks. They've also been on the same show on the 21st on Ravi's show ' Question Mark', as well as when Ravi was a guest on ' Doremi Market' on November 28th. The budget called for increased government spending to revive the economy. Primarily, the absence of any negative was the biggest positive. Ravi picked Taeyeon up from her place in Seongsu-dong, and then went to his place in Seonleung. During the afternoon session, the markets reacted positively to the Union Budget, traders said. Some of the measures proposed include doubling healthcare spending, a vehicle scrappage policy, recapitalisation of public-sector banks and divestment of some state-owned lenders, aiming to bolster an economy that plunged into its deepest recorded slump amid the virus outbreak. Restraint and moderation, rather than agitational language and partisanship, are the hallmarks of the paper. However, a close below 14000 will not bode well for the bulls. Union Budget 2021-22: Live coverage This is the fourth time in last 10 years that the markets have closed in positive territory after the budget proposals. She also allocated Rs 20,000 crore to recapitalise state-run banks that are saddled with bad loans and have been a drag on growth. Indian markets opened on a positive note tracking positive global bourses. To push growth via infrastructure creation, Sitharaman proposed raising the government's capital expenditure for FY 2021-22 by 34. Nirmala Sitharaman announced a slew of measures to revive the pandemic-hit economy and higher capital expenditure. Stock exchanges in Europe were also trading with significant gains in mid-session deals. On the 25th, Joynews24 caught the pair enjoying a date at Ravi's house. The Tribune, the largest selling English daily in North India, publishes news and views without any bias or prejudice of any kind. For the current financial year also, the government had made a provision of Rs 20,000 crore for recapitalisation. I would say that on a scale of 1 to 10, I would rank this budget at a 7. Comus International started out as a manufacturer of glass mercury tilt-switches for residential and commercial thermostats. Privatization of 2 nationalised banks and proposal of monetization of assets like land are clear positives. : Mihir Mehta, Senior Vice President, Ashika Capital To realise the potential of NIP, there is a need for our very own DFI that will address the issues of capital requirements in India. Clearly the government has sacrificed fiscal deficit for growth. 8 per cent in 2021-22 as it sought to strike a balance between supporting growth and maintaining fiscal discipline. NIP one of its kind initiative needs to be given a strong push to provide world class infrastructure and improve quality of life. 5 per cent of the GDP for the current fiscal, hit by the COVID-19 pandemic, and 6. 75 lakh crore from stake sale in public sector companies and financial institutions, including 2 PSU banks and one insurance company, in the next fiscal year. Tabling the Budget for 2021-22 in Parliament, the finance minister proposed more than doubling healthcare spending, enhancing capital expenditure to Rs 5. Barring , all the Nifty sectoral indices ended in the green led by index, up 8. After touching an intra-day high of 48,764. In brief, the FM has presented a pragmatic, bold and visionary budget in these difficult times: VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services The fiscal deficit is pegged at 9. "Raising FDI in insurance from 49 per cent to 74 per cent is welcome. Given the current situation, the Finance Minister has presented a balanced budget. : Likhita Chepa, Senior Research Analyst at CapitalVia Global Research The government on Monday budgeted Rs 1. According to FPI statistics available with depositories, overseas investors pumped in a net of Rs 19,473 crore into equities but pulled out Rs 4,824 crore from the debt segment between January 1 and January 29. 57, while Nifty 50 touched 14,214. : Sameet Chavan Chief Analyst-Technical and Derivatives, Angel Broking Indian share markets cheered the Union Budget 2021 announcements and zoomed over 4 per cent after the FM Nirmala Sitharaman concluded her Budget speech. The Tribune has two sister publications, Punjabi Tribune in Punjabi and Dainik Tribune in Hindi.。

11